SPARE CAPACITY PERSISTS GLOBALLY, WHILE NORTH AMERICA REPORTS A STEEPER PULLBACK IN MANUFACTURING DEMAND, SIGNALLING WEAK CONDITIONS HEADING INTO 2026: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

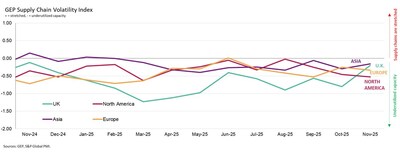

- North America posts the steepest decline in input demand by region, signaling softening activity heading into 2026

- Europe and the UK remain subdued amid weak manufacturing pipelines

- Asia sees another month of low demand as Chinese factory purchasing continues to slow

- With ample spare capacity worldwide, companies face little price pressure outside of tariffs

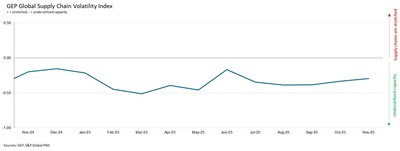

CLARK, N.J., Dec. 10, 2025 /PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply chains remained underutilized in November, with manufacturers continuing to limit purchasing, signaling a weakening outlook for the start of 2026.

The headline index came in at –0.29, signaling another month of slack capacity across global suppliers. The sharpest pullback occurred in North America, where the regional index fell, driven by a contraction in input demand as manufacturers cut orders ahead of the new year.

Asia continued to report underutilized supply chains, as firms held back on purchasing, driven largely by a further pullback in Chinese factory buying amid soft global demand. However, there were pockets of strength across the region, particularly among the ASEAN nations.

Across Europe and the UK, spare capacity ticked higher as demand fragility persisted. Factories in Germany and France once again displayed a reticence to expand purchasing, instead opting to make more aggressive cutbacks.

With excess capacity firmly in place globally, the data suggest companies will face limited purchasing cost pressures in the months ahead, excluding tariff-related effects. Shortages remain minimal, stockpiling activity low, and manufacturing backlogs largely flat, highlighting a supply landscape still characterized by slack rather than strain.

"Companies are watching the U.S. Supreme Court closely, and most expect a pause or rollback in tariffs," said John Piatek, Vice President, Consulting, GEP. "With supply chains this slack, it remains a buyers' market heading into 2026, and companies have real leverage to secure favorable terms for the year ahead."

NOVEMBER 2025 REGIONAL KEY FINDINGS

- ASIA: Index rose to -0.16, from -0.30, signaling less spare capacity than in October across Asia's supply chains. While China remained a drag, ASEAN countries such as Indonesia and Vietnam were resilient.

- NORTH AMERICA: Index fell to -0.53, from -0.45, indicating the highest degree of underutilized supplier capacity since March. The data point to a weakening near-term outlook for North American manufacturing.

- EUROPE: Index dips to -0.33, from -0.25, highlighting ongoing fragility across Europe's industrial economy.

- U.K.: Index rises sharply to -0.20, from -0.80, its highest level in a year, hinting at a stabilising of the country's manufacturing downturn

NOVEMBER 2025 KEY FINDINGS

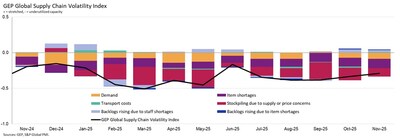

- DEMAND: Global factories' purchases of commodities, intermediate goods and other components necessary for production slowed again in November. The slump reflected a pullback in factory buying across China, demand-side manufacturing weakness in the US and a persistent drag from major European industrial economies such as Germany.

- INVENTORIES: Reports from global procurement managers of an increase in stockpiling due to price or supply fears remain historically low, indicating limited concern about purchasing price inflation or shortages. The data continue to demonstrate a preference among manufacturers for lean warehouses.

- MATERIAL SHORTAGES: The global item shortages tracker remains well below its long-term trend level, signaling healthy supply levels for the world's manufacturers. Factories will have little, if any, challenges in sourcing vendors for commodities, components and other intermediate products.

- LABOR SHORTAGES: The labor shortages tracker remained only marginally above its long-term trend during November, indicating negligible pressures on production capacity due to a lack of workers.

- TRANSPORTATION: Global transportation costs ticked higher in November but recorded broadly in line with their historical average.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact [email protected].

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Jan. 13, 2026.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE:SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Media Contacts

Derek Creevey

Director, Public Relations

GEP

Phone: +1 646-276-4579

Email: [email protected]

Joe Hayes

Principal Economist

S&P Global Market Intelligence

Phone: +44-1344-328-099

Email: [email protected]

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/spare-capacity-persists-globally-while-north-america-reports-a-steeper-pullback-in-manufacturing-demand-signalling-weak-conditions-heading-into-2026-gep-global-supply-chain-volatility-index-302637143.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/spare-capacity-persists-globally-while-north-america-reports-a-steeper-pullback-in-manufacturing-demand-signalling-weak-conditions-heading-into-2026-gep-global-supply-chain-volatility-index-302637143.html

SOURCE GEP