Global bidding activity improves as commercial real estate investment cycle gains momentum

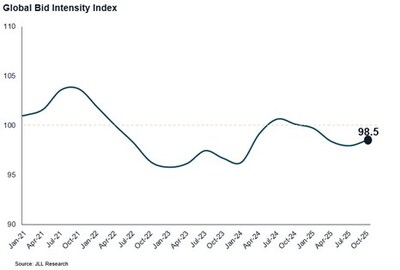

JLL's Global Bid Intensity Index rose in October, signaling continued capital flow growth and increased market competition in the coming months

CHICAGO, Nov. 25, 2025 /PRNewswire/ -- Bidder competitiveness has continued to improve globally, suggesting growth in capital flows, across several asset classes, following a period of uncertainty. This is according to JLL's (NYSE:JLL) proprietary Global Bid Intensity Index, a leading indicator for future capital flows that offers a real-time view on improving liquidity and competitiveness across global private real estate capital markets.

After bidder dynamics marked a turning point in July, the first improvement in 2025, momentum has continued to pick up. October posted the second-highest monthly gain over the past year in bidder dynamics, as competitiveness continues to improve—underpinned in part by the Federal Reserve's interest rate cuts in September and October.

"As capital deployment accelerated during the third quarter, institutional investors are signaling increased confidence in the market, even as uncertainty persists," said Richard Bloxam, CEO, Capital Markets, JLL. "We expect business confidence will continue to improve and pave the way for continued capital flow growth into 2026."

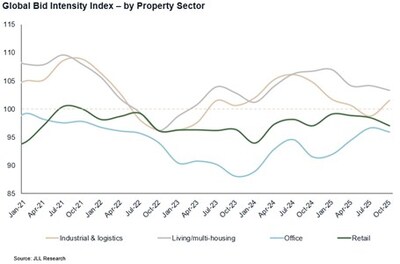

The Living / Multi-Housing sector continues to lead bidding activity and sees the most competitive dynamics among property sectors, buoyed by near-record dry powder and housing shortages across many major markets. Bidding competitiveness also rebounded in Industrial and Logistics as trade policy uncertainty lessened, and Retail liquidity is deepening for additional retail asset subtypes. While more transaction launches led to some softening in bidding competitiveness, consumer and retail spending continues to exceed expectations.

For the Office sector, bid dynamics are on a remarkable upward path compared to all-time lows in late 2023. Investment sentiment shows a clear improvement from trough, with growing bidder pools and increased lender participation.

"Property sector performance fundamentals are holding up and asset valuations have generally held firm so far in 2025," said Bloxam. "While market uncertainty will continue to impact decision-making, the growth picture is looking more positive for 2026. Having worked through various junctures of uncertainty over the past year, more investors are showing a higher tolerance for risk. Coupled with the exceptionally strong debt markets, we expect this will catalyze continued improvement in liquidity."

For more news, videos and research resources on JLL, please visit JLL's newsroom.

About Global Bid Intensity Index

The Global Bid Intensity Index measures direct investment market competitiveness through analysis of JLL's proprietary bid data. The index combines three sub-indices to provide forward-looking insights on private real estate capital markets momentum globally, providing investors early signals into where competition and pricing are headed, ahead of third-party data providers.

About JLL

For over 200 years, JLL (NYSE:JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $23.4 billion and operations in over 80 countries around the world, our more than 113,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Contact: Jesse Tron

Phone: +1 212 376 1216

Email: [email protected]

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/global-bidding-activity-improves-as-commercial-real-estate-investment-cycle-gains-momentum-302625730.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-bidding-activity-improves-as-commercial-real-estate-investment-cycle-gains-momentum-302625730.html

SOURCE JLL