EPIC Crude Delivers Record Volumes

EPIC Crude delivering record volumes of 500,000 barrels per day

EPIC Crude Holdings, LP ("EPIC Crude" or "the Company") continues to ship record crude volumes of 500,000 barrels per day during 2022. EPIC Crude provides shippers access to the premium Corpus Christi market including EPIC Crude's export facility as well as local refineries and other export docks. The overall quality of crude being transported continues to differentiate EPIC Crude from other transport providers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220406005205/en/

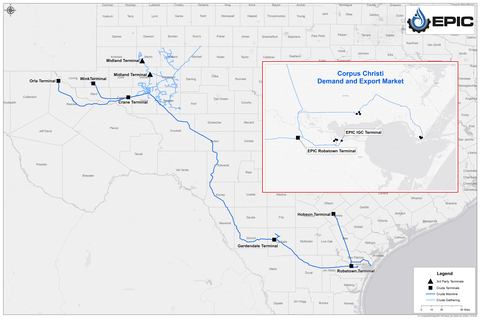

Crude Map (Graphic: Business Wire)

"This has been a great start to the year for EPIC Crude," said Brian Freed, Chief Executive Officer of EPIC. "Our crude volume throughput proves EPIC's strategic importance for customers to provide safe and reliable crude oil transport out of the Delaware, Midland and Eagle Ford basins into the Corpus Christi market. We have strategically positioned ourselves to take advantage of the growth we are seeing in the Permian basin and the Corpus Christi premium export markets."

About EPIC Crude Holdings, LP

EPIC Crude Holdings, LP ("EPIC Crude") was formed in 2017 to build and operate the EPIC Crude Oil Pipeline, a 700-mile, 30" crude oil pipeline that extends from Orla, Texas to the Port of Corpus Christi and services the Delaware, Midland and Eagle Ford basins. The Crude Oil Pipeline is currently operating at a capacity of 600,000 barrels per day (bpd), as well as total operational storage of approximately 7,500,000 million barrels. The project includes terminals in Orla, Pecos, Crane, Wink, Midland, Hobson and Gardendale, with connectivity to the Port of Corpus Christi, including the EPIC Marine Terminal, third-party export terminals and local refineries. EPIC Crude is backed by capital commitments from funds managed by the Private Equity Group of Ares Management Corporation (NYSE:ARES) as well as additional equity ownership by Chevron Corporation (NYSE:CVX), Kinetik (NASDAQ:KNTK) and Rattler Midstream LP (NASDAQ:RTLR). For more information, visit www.epicmid.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220406005205/en/