2025 drilling further extends near-mine resources, returns multi-kilo silver grades at San Miguel and discovers new mineralization at East Palmarejo

Coeur Mining, Inc. ("Coeur" or the "Company") (NYSE:CDE) today provided an update on the 2025 exploration program at its Palmarejo gold-silver complex located in southwest Chihuahua, Mexico, which marks its largest exploration campaign since 2012 with approximately 68,000 meters of diamond drilling by eleven drill rigs across its extensive 300 km2 land package of which only 3% has been explored to date.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251208940780/en/

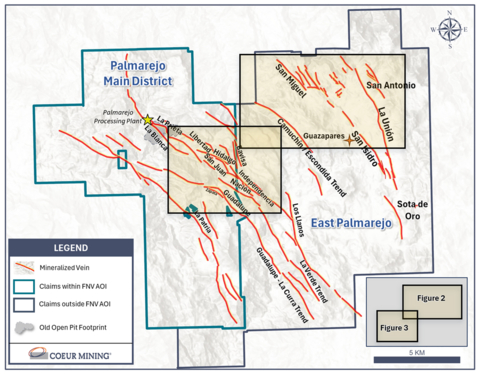

Figure 1: Map of Palmarejo Main and East Palmarejo showing main vein trends

The program has successfully identified numerous resource growth opportunities that represent mine life extension opportunities through a balance of near-mine and district-scale exploration focused on four primary objectives:

- Step-out and expansion drilling along the near-mine Hidalgo Corridor (Hidalgo, Libertad, and San Juan veins) to increase near-mine inferred resources and support future reserve conversion

- Validation drilling at the Independencia Sur deposit located outside of the Franco Nevada gold stream to confirm historical resources and test its continuity with the Independencia Norte system, which is currently being mined

- Validation and expansion drilling of historical resources at San Miguel and La Unión, which are located further to the east of the Palmarejo mine and outside the Franco Nevada gold stream, which are delivering results that highlight the area's significant untapped potential

- Scout drill-testing of new targets located to the east of Palmarejo to further demonstrate the area's significant potential, which has resulted in a new discovery

Key Highlights1,2,3

-

Near-Mine Expansion Drilling Extends Multiple Vein Systems Along the Hidalgo Corridor

-

Hidalgo, Libertad, and San Juan veins have been extended along strike by 500 meters, 300 meters, and 150 meters, respectively (totaling a combined strike length of 5.2 kilometers since the Hidalgo deposit was discovered in 2019)

- Hole HGDH-209 (Hidalgo) returned 8.2 feet at 0.31 ounces per ton ("oz/t") gold and 19.74 oz/t silver (2.5 meters at 10.6 grams per tonne ("g/t") gold and 677 g/t silver)

- Hole HGDH-215 (Libertad) returned 3.0 feet at 0.11 oz/t gold and 10.39 oz/t silver (0.9 meters at 3.9 g/t gold and 356 g/t silver)

- Hole HGDH-203 (San Juan) returned 12.3 feet at 0.54 oz/t gold and 22.69 oz/t silver (3.7 meters at 18.6 g/t gold and 778 g/t silver)

-

Hidalgo, Libertad, and San Juan veins have been extended along strike by 500 meters, 300 meters, and 150 meters, respectively (totaling a combined strike length of 5.2 kilometers since the Hidalgo deposit was discovered in 2019)

-

Confirmed Continuity Between Independencia Sur and Independencia Norte

-

Drilling confirmed continuity and identified additional hanging-wall veins between Independencia Sur and Independencia Norte vein (currently in production)

- Hole VIDH-181 returned 19.7 feet at 0.11 oz/t gold and 10.79 oz/t silver (6.0 meters at 3.6 g/t gold and 370 g/t silver)

- Hole VIDH-188 returned 17.9 feet at 0.03 oz/t gold and 5.26 oz/t silver (5.5 meters at 1.1 g/t gold and 180 g/t silver)

-

Drilling confirmed continuity and identified additional hanging-wall veins between Independencia Sur and Independencia Norte vein (currently in production)

-

Inaugural East Palmarejo Drilling Signals Potential for New Chapter of Growth

- Initial drilling at San Miguel and La Unión has returned exceptional near-surface gold and silver results indicating strong potential for meaningful resource additions. Key results include:

San Miguel

- Hole SMDH-107 returned 58.8 feet at 0.12 oz/t gold and 54.55 oz/t silver (17.9 meters at 4.2 g/t gold and 1,870 g/t silver), including 29.9 feet at 0.21 oz/t gold and 105.28 oz/t silver (9.1 meters at 7.1 g/t gold and 3,610 g/t silver), one of the best assays ever returned at Palmarejo

- Hole SMDH-102 returned 34.2 feet at 0.12 oz/t gold and 44.25 oz/t silver (10.4 meters at 4.1 g/t gold and 1,517 g/t silver), including 4.9 feet at 0.45 oz/t gold and 144.59 oz/t silver (1.5 meters at 15.4 g/t gold and 4,957 g/t silver)

- Hole SMDH-110 returned 34.5 feet at 0.12 oz/t gold and 56.24 oz/t silver (10.5 meters at 4.1 g/t gold and 1,928 g/t silver), including 9.8 feet at 0.34 oz/t gold and 156.52 oz/t silver (3.0 meters at 11.5 g/t gold and 5,366 g/t silver)

- Hole SMDH-115 returned 17.0 feet at 0.43 oz/t gold and 132.05 oz/t silver (5.2 meters at 14.7 g/t gold and 4,527 g/t silver)

La Unión

- Hole LUDH-088 returned 72.9 feet at 0.19 oz/t gold and 0.74 oz/t silver (22.2 meters at 6.7 g/t gold and 26 g/t silver)

- Hole LUDH-091 returned 20.9 feet at 0.14 oz/t gold and 0.30 oz/t silver (6.4 meters at 5.0 g/t gold and 11 g/t silver)

- New Discovery in Camuchín Trend Located in East Palmarejo

-

Drilling confirms gold and silver mineralization along 900 meters of strike along the 4-kilometer Camuchín – Escondida trend

- Hole CMDH-011 returned 10.2 feet at 0.04 oz/t gold and 12.02 oz/t silver (3.1 meters at 1.4 g/t gold and 412 g/t silver)

- Hole CMDH-017 returned 10.4 feet at 0.05 oz/t gold and 5.98 oz/t silver (3.2 meters at 1.6 g/t gold and 205 g/t silver)

"Following a 75% increase in Palmarejo's inferred mineral resources last year, our 2025 program has generated additional discoveries and leaves the operation well positioned for further mine life extensions," said Mitchell J. Krebs, Chairman, President, and Chief Executive Officer. "The 2025 commencement of drilling in the underexplored areas located on the large land position we have now consolidated immediately to the east of Palmarejo represents a major step in Palmarejo's expansion efforts. With a 300 km2 total land package that is just 3% drilled, we are only scratching the surface of the next phase of Palmarejo's potential growth and development. Brownfields exploration will remain a critical component of our capital allocation strategy going forward given the high returns these investments can generate at existing operations such as Palmarejo."

For a complete table of all drill results, please refer to the following link: https://s201.q4cdn.com/254090064/files/doc_downloads/2025/12/2025-12-08-Exploration-Update-Appendix-Final.pdf. Please see the "Cautionary Statements" section for additional information regarding drill results.

NEAR-MINE EXPLORATION – PALMAREJO MAIN DISTRICT

The 2025 near-mine exploration program focused on step-out drilling around near-mine veins to support inferred resource ounce additions and support long-term mine life extensions, to build on the success of the 2024 program.

Hidalgo Corridor

Since its discovery in 2019, Hidalgo has become Palmarejo's second largest reserve after the Guadalupe deposit, which has been mined since 2014. The 2025 drilling campaign has continued to demonstrate significant growth potential along the Hidalgo, Libertad, and San Juan vein trends which represent northwest extensions of the Independencia system that lie closer to the Palmarejo mill and processing facility.

Step-out drilling northwest along the Hidalgo and Libertad trends successfully extended mineralized zones by approximately 500 meters and 300 meters, respectively. Multiple high-grade vein structures and splays have been intersected, which are expected to contribute to inferred resource growth.

In addition, drilling along the San Juan trend extended mineralization along an approximately 150-meter strike, where the newly defined veins and splays exhibit grades and widths comparable to those found in the Independencia and Guadalupe systems. Collectively, the Hidalgo Corridor has now been drilled over a total length of 1.55 miles (2.5 kilometers) and remains open along strike and down dip.

Initiated in 2023, the ongoing expansion drilling program along the Hidalgo Corridor continues to deliver encouraging results and is expected to justify additional underground development to support further drilling, resource expansion, and reserve additions.

Independencia Sur

The Independencia Sur vein represents the southeastern extension of the Independencia Norte vein, which is the primary source of production at Palmarejo. The target lies adjacent to underground infrastructure – a key advantage for future mine development – along the southeastern continuation of the Guadalupe – La Nación system.

Following its acquisition from Fresnillo in 2024, Coeur has undertaken detailed mapping, relogging of historic drill core, and conducted validation drilling to confirm previous results. The 2025 drill program consists of 26 kilometers of diamond drilling and is designed to establish a compliant mineral resource estimate.

Drilling from both surface and underground platforms has been conducted along a 2.5-kilometer strike length, confirming and refining the known vein geometry. The program successfully intersected five new veins drilled over strike lengths ranging from 300 meters to 800 meters, three of which represent parallel splays in the hanging-wall of the Independencia Sur system. Broad zones of breccia and quartz-calcite veins hosted in rhyolite porphyry returned the highest grades along contact zones with basalts.

Highlights include intercepts of up to 19.7 feet grading 0.11 oz/t gold and 10.79 oz/t silver (6.0 meters at 3.6 g/t gold and 370 g/t silver); Hole VIDH-181. Drilling from the La Nación underground workings targeting an undrilled 150-meter gap between the Independencia Sur and Independencia Norte veins successfully connected the two structures as shown in Figure 2, which will be infill drilled in early 2026 to support near-term reserve additions.

EAST PALMAREJO EXPLORATION

Coeur's 2025 exploration program marked the commencement of drilling in East Palmarejo, a large, underexplored area located outside the Franco-Nevada gold stream area of interest and centered around the historic mining town of Guazapares. Most of the known deposits and occurrences of gold and silver are located along two bifurcating northwest-trending fault zones called the San Miguel – San Isidro and the San Antonio – La Unión trends some ten and eight kilometers in length respectively, as seen in Figure 3. These trends are sparsely drilled and continued exploration is expected to produce additional discoveries.

Prospectivity within the unexplored Camuchín – Escondida Zone, a 4-kilometer-wide area between the Palmarejo main trend and the San Miguel – San Isidro trend, was underscored by the discovery of the Camuchín trend where 2025 drilling confirmed mineralization over 900 meters, further supporting the Zone's potential.

San Miguel

During 2025, Coeur commenced drilling at San Miguel for the first time, with initial results confirming potential for high-grade gold and silver. Mineralization is hosted within a series of steep southwest-dipping hydrothermal breccias and epithermal veins developed along the contact between rhyolitic tuffs and basalts. Approximately 400 meters of its defined strike length is characterized by historic colonial-era surface workings.

The program was designed to validate historical drilling undertaken by Paramount Gold and Silver Corp. from 2007 to 2011 and confirm the continuity and grade of mineralization. Coeur completed 17 diamond drill holes totaling 6,075 meters, which extended the deposit by 90 meters along strike and 100 meters down dip (current length and dip of the deposit are now 1.3 kilometers and 360 meters, respectively).

The near-surface mineralization remains open along strike to the northwest, southeast and at depth, indicating strong potential for resource growth. The San Miguel trend has been mapped on surface for four kilometers and forms part of a broader mineralized corridor extending southeast through San Isidro to Sota de Oro where it merges with the north-northwest-trending corridor that hosts the La Unión and San Antonio deposits, as shown in Figure 3. The Company plans to continue drilling scout and step-out holes along both trends in 2026 to test for extensions of the system.

La Unión

Gold and silver mineralization at La Unión is hosted within steeply dipping zones of stockwork veining and hydrothermal breccias in rhyolitic tuffs and andesites. The deposit is within a broad north-northwest-trending structural corridor extending for more than eight kilometers, linking the San Antonio prospect to the north and the La Carmela vein system to the south.

Coeur completed 16 diamond drill holes totaling 6,064 meters testing a strike length of approximately 1,050 meters. The program was designed to validate historical drilling and refine structural interpretations. Assays from two holes have been received to date, including 72.9 feet at 0.19 oz/t gold and 0.74 oz/t silver (22.2 meters at 6.7 g/t gold and 26 g/t silver) in LUDH-088, as shown in Figure 3, supporting the broad widths of the near-surface mineralization observed in historical drilling. This drilling also extended the deposit down dip by 170 meters to 290 meters. Assays from remaining holes are pending.

Mapping and previous drilling at La Unión outlined a 1.8-kilometer structure which remains open along strike and at depth. Follow-up drilling is planned to expand mineralization both northward toward San Antonio and southward towards Carmela.

Camuchín

The Camuchín discovery represents a major new mineralized trend located between the Palmarejo mine and San Miguel – approximately six kilometers northeast of Palmarejo and 2.8 kilometers southwest of San Miguel. Mapping and geochemical sampling in 2024 led to the identification of the northwest-trending Camuchín – Escondida fault-vein system, marking the first known mineralization within the previously untested 4-kilometer-wide gap between the Guazapares and Palmarejo mining trends, now known as the Camuchín – Escondida trend.

To date, Coeur has completed 21 diamond drill holes, with mineralization intersected in 14 holes drilled over a strike length exceeding 900 meters. Mineralization remains open to the southeast, where surface mapping suggests several kilometers of potential strike extension.

The discovery of Camuchín, together with the high-grade results from San Miguel and La Unión, demonstrate that Coeur's ongoing district-scale exploration program is successfully unlocking the untapped potential of East Palmarejo, establishing a strong foundation for future resource growth and mine life expansion across the Palmarejo complex. A target generation program is currently underway utilizing recent regional geophysical surveys, geology and geochemistry.

"Coeur's multi-pronged exploration strategy at Palmarejo is delivering strong results," said Aoife McGrath, Senior Vice President, Exploration. "From near-mine to regional-scale programs, we're enhancing mine-life visibility and future operational and financial flexibility. We see significant upside and expect continued strong returns on our exploration investment."

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly owned operations: the Las Chispas silver-gold mine in Sonora, Mexico, the Palmarejo gold-silver complex in Chihuahua Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip polymetallic critical minerals exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures and investments, drill results, resource delineation, expansion, upgrade or conversion and mine life extension. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned exploration programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade and recovery variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves and mineral resources, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur's future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Forms 10-K and 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a "qualified person" under Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended ("SK 1300"), namely our Vice President, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources for Coeur's material properties included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company's material properties which are available at www.sec.gov.

Notes

The ranges of potential tonnage and grade (or quality) of the exploration results described herein are conceptual in nature. There has been insufficient exploration work to estimate a mineral resource. It is uncertain if further exploration will result in the estimation of a mineral resource. The exploration results described in this news release therefore do not represent and should not be construed to be an estimate of a mineral resource or mineral reserve.

- 2024 reserves and resources were determined in accordance with Item 1300 of SEC Regulation S-K. Reserves and resources for certain prior periods were determined in accordance with Canadian National Instrument 43-101. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions.

- For a complete table of all drill results included in this release, please refer to the following link https://s201.q4cdn.com/254090064/files/doc_downloads/2025/12/2025-12-08-Exploration-Update-Appendix-Final.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

- Gold equivalence assumes gold-to-silver, -lead, -zinc ratios of 1:60, 1:1,200 and 1:1,000, respectively.

Conversion Table |

||

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251208940780/en/

For Additional Information

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Chicago, Illinois 60606

Attention: Jeff Wilhoit, Senior Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com