ARIS MINING REPORTS Q3 2024 GOLD PRODUCTION, UPDATES SEGOVIA RESERVE AND RESOURCE ESTIMATES AND EXPANSION MILESTONES

VANCOUVER, BC, Oct. 7, 2024 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX:ARIS) (NYSE-A: ARMN) announces gold production results of 53,608 ounces (oz) for Q3 2024, with 47,493 oz from Segovia and 6,115 oz from the Marmato Upper Mine. This represents a 9% increase over total gold production in Q2 2024. Additionally, the Company has made significant progress on expansion projects at Segovia and has updated mineral resource and mineral reserve estimates with an effective date of July 31, 2024. At the Marmato Lower Mine, construction is advancing on schedule and has crossed the 25% spend threshold.

Neil Woodyer, CEO of Aris Mining, commented "We are pleased to share the continued progress of our Segovia and Marmato expansion projects, which position Aris Mining to achieve an annual gold production rate of approximately 500,000 oz in the second half of 2026. The first phase of the Segovia Expansion, which includes an expanded receiving area for mill feed from our mining partners, has been successfully commissioned. Phase 2 of the Segovia Expansion is underway and is on track for completion in Q1 2025. Following completion and ramp-up, Segovia's gold production is expected to exceed 300,000 oz per year. This growth is driven by a focused exploration strategy that has consistently increased gold resources and replaced gold reserves. Additionally, construction of the Marmato Lower Mine remains on schedule, and we continue to advance the studies for the redesigned and smaller environmental footprint Soto Norte project for early 2025."

Segovia – Expansion updates

Phase 1 of the Segovia expansion is complete with the newly expanded receiving area for our contract mining partners (CMPs) fully commissioned and being handed over to operations. The expanded receiving area enhances mill feed capacity and operational efficiencies. Phase 2, which involves installing a second ball mill in the former contractor receiving area, is underway and scheduled for completion in Q1 2025. The new ball mill will increase throughput and enable finer grinding, process efficiency and gold production.

Gold production from Segovia in Q3 2024 totaled 47,493 oz, reflecting a 9% increase over Q2 2024. With the expansion ramp-up in mind, Aris Mining is targeting gold production from Segovia of 185,000 to 195,000 oz in 2024, 250,000 oz in 2025 and over 300,000 oz in 2026.

Segovia – Updated Mineral Resource and Mineral Reserve Estimates

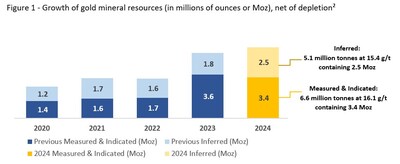

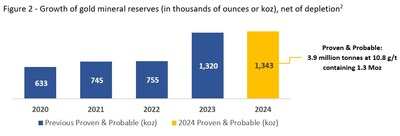

As announced in our August 2024 exploration drilling results news release1, Segovia's exploration programs continue to deliver high-grade intersections. These results are included in updated estimates effective July 31, 2024, resulting in growth of the mineral resources and full replacement of the mineral reserves (see Figures 1 and 2 below). These new estimates build on the strong growth in 2023 and support the ongoing Segovia expansion project. The 2025 drilling program is expected to focus on these newly identified near-mine mineral resources, aiming to convert them into mineral reserves with low development costs.

_________________________ |

1 See news release dated August 12, 2024 titled "Aris Mining Announces High Grade Drill Results from Ongoing Segovia Operations Exploration Program". |

Marmato expansion updates

The Marmato Lower Mine expansion is progressing on schedule, with the site access road and portal face now complete and the contractor preparing to initiate work on the twin declines. Both the SAG and ball mill fabrication are progressing on schedule for completion before the end of 2024. Annual gold production from the Marmato Upper and Lower mines is expected to grow to an average of 162,000 ounces over a 20-year mine life once the Lower Mine is operational3.

As of September 30, 2024, the project reached the "25% spend" milestone required for the first milestone payment under the precious metals purchase agreement with Wheaton Precious Metals (WPMI). WPMI has been notified, and the US$40 million first milestone payment is expected to be received before the end of the month, with additional US$40 million and US$42 million payments at the 50% and 75% spend milestones, respectively.

_____________________________ |

2 See Tables 1 and 2 for the full breakdown of tonnes, grade, and ounces by category and the "Technical Disclosure and Qualified Person" section below for full disclosure of technical and scientific details. |

3 See the "Technical Disclosure and Qualified Person" section below for full disclosure of technical and scientific details. |

Technical Disclosure

The table below summarizes the 2024 mineral resource estimate (the 2024 MRE) together with the disclosure of several years of previous mineral resource estimates.

Table 1 - Segovia Operations mineral resource estimates4

Effective date | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | |

31–Jul-2024 | 3,637 | 16.03 | 1,875 | 2,943 | 16.07 | 1,521 | 6,580 | 16.05 | 3,396 | 5,138 | 15.38 | 2,541 |

30–Sep-2023 | 4,114 | 14.31 | 1,893 | 3,754 | 14.38 | 1,736 | 7,869 | 14.34 | 3,629 | 4,682 | 12.11 | 1,823 |

31-Dec-2022 | 405 | 15.39 | 200 | 4,569 | 10.16 | 1,492 | 4,974 | 10.58 | 1,692 | 5,325 | 9.44 | 1,616 |

31-Dec-2021 | 462 | 14.00 | 208 | 4,123 | 10.65 | 1,412 | 4,585 | 10.99 | 1,620 | 5,349 | 9.90 | 1,703 |

31-Dec-2020 | 327 | 19.78 | 208 | 3,640 | 10.40 | 1,217 | 3,967 | 11.17 | 1,425 | 3,661 | 10.28 | 1,210 |

Notes: • Mineral resources are inclusive of mineral reserves. • Mineral resources are not mineral reserves and have no demonstrated economic viability. • There are no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the mineral resource estimate. • Totals may not add due to rounding. 2024 MRE Notes: • A gold price of US$2,100 per ounce was used for the 2024 MRE. • The 2024 MRE utilized a gold cut-off grade of between 2.84 g/t and 3.81 g/t depending on mineral resource area. The cut-off grade values were applied to vein grades diluted to a minimum mining width of one vertical metre. • The 2024 MRE was prepared by Pamela De Mark, P.Geo., Senior Vice President of Geology and Exploration of Aris Mining, who is a Qualified Person as defined by NI 43-101. Previous MRE Notes: • The mineral resource estimate used a US$ gold price of $1,700 in 2020, $1,800 in 2021, and $1,850 in 2022 and 2023 to determine a gold cut-off grade of 2.9 g/t in 2020 and 2021, 2.65 g/t in 2022, and between 2.80 g/t and 3.12 g/t in 2023, depending on mineral resource area, all using a minimum mining width of 1.0 m. | ||||||||||||

_____________________________ |

4 See the "Technical Disclosure and Qualified Person" section below for full disclosure of technical and scientific details. |

Table 2 below summarizes the 2024 mineral reserve estimate together with several years of previous mineral reserve estimates.

Table 2 - Segovia Operations mineral reserve estimates5

Effective date | Proven | Probable | Proven & Probable | ||||||

Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | Tonnes (kt) | Grade Au (g/t) | Oz Au (koz) | |

31–Jul-2024 | 1,886 | 11.25 | 682 | 1,989 | 10.33 | 660 | 3,875 | 10.78 | 1,343 |

30–Sep-2023 | 1,515 | 12.25 | 597 | 2,017 | 11.16 | 723 | 3,531 | 11.63 | 1,320 |

31-Dec-2022 | 229 | 10.92 | 81 | 2,132 | 9.84 | 675 | 2,361 | 9.95 | 755 |

31-Dec-2021 | 204 | 12.00 | 79 | 2,087 | 9.93 | 666 | 2,290 | 10.11 | 745 |

31-Dec-2020 | 187 | 13.86 | 83 | 2,009 | 8.51 | 550 | 2,196 | 8.96 | 633 |

Notes: • There are no known mining, legal, political, metallurgical, infrastructure, permitting, or other relevant factors that could materially affect the mineral reserve estimate. • Totals may not add due to rounding. 2024 Mineral Reserve Notes: • A gold price of US$1,915 per ounce was used for the 2024 mineral reserve estimate. • The 2024 mineral reserve estimate utilized a gold cut-off grade of between 3.11 g/t and 4.18 g/t depending on mineral resource area. The cut-off grade values were applied to vein grades diluted to a minimum mining width that varies according to the mining area. • The 2024 mineral reserve estimate was prepared by Aris Mining technical staff under the supervision of and reviewed by Miguel Marcelo Roldán, FAusIMM, Technical Services Manager, Segovia Operations, of Aris Mining, who is a Qualified Person as defined by NI 43-101. Previous Mineral Reserve Notes: • The mineral reserve estimate used a US$ gold price per ounce of $1,600 in 2020, $1,650 in 2021, and $1,700 in 2022 and 2023. | |||||||||

The technical information in this news release was reviewed and approved by Pamela De Mark, P.Geo, Senior Vice President, Geology and Exploration of Aris Mining, who is a Qualified Person as defined by NI 43-101. Ms. De Mark has fully verified the sampling, analytical, and test data as well as the geological interpretation underlying the information or opinions disclosed in this news release by way of analysis of the data and the geological interpretations while preparing the 2024 MRE and reviewing the mineral reserve estimate.

___________________________ |

5 See the "Technical Disclosure and Qualified Person" section below for full disclosure of technical and scientific details. |

Unless otherwise indicated, the mineral resource and reserve estimates, scientific disclosure, and technical information included in this news release are based upon information included in the following documents and NI 43-101 compliant technical reports:

- for the annual gold production at Marmato, the technical report entitled "Technical Report for the Marmato Gold Mine, Caldas Department, Colombia, PFS of the Lower Mine Expansion Project" dated November 23, 2022 and effective as of June 30, 2022, and prepared by SRK, Ausenco, Piteau Associates, and Aris Mining;

- for the mineral resource and reserve estimate effective December 31, 2020, the technical report entitled "NI 43-101 Technical Report, Prefeasibility Study Update, Segovia Project, Department of Antioquia, Colombia" dated May 13, 2021 and effective as of December 31, 2020 and prepared by SRK;

- for the mineral resource and reserve estimate effective December 31, 2021, the technical report entitled "NI 43-101 Technical Report, Prefeasibility Study, Segovia Project, Antioquia, Colombia" dated May 6, 2022 and effective as of December 31, 2021 and prepared by SRK;

- for the mineral resource and reserve estimate effective December 31, 2022, the mineral reserve estimates of the Segovia Operations are summarized, derived, or extracted from the news release of the Company dated March 3, 2023; and

- for the mineral resource and reserve estimate effective September 30, 2023, the technical report entitled "NI 43-101 Technical Report for the Segovia Operations, Antioquia, Colombia" dated December 6, 2023 and effective as of September 30, 2023 and prepared by Aris Mining.

All of the documents referenced in this news release are available for review on the Company's website at www.aris-mining.com and on the Company's profile on SEDAR+ at www.sedarplus.ca.

About Aris Mining

Aris Mining is a gold producer in the Americas, currently operating two mines with expansions underway in Colombia. The Segovia Operations and the Marmato Upper Mine produced 226,000 ounces of gold in 2023. Aris Mining is targeting a production rate of approximately 500,000 ounces of gold per year in the second half of 2026, following a ramp-up period after the Segovia mill expansion scheduled for completion in Q1 2025 and the Marmato Lower Mine's first gold pour in late 2025. Aris Mining also operates the 51% owned Soto Norte joint venture, where studies are underway on a new, smaller scale development plan, with results expected in early 2025. In Guyana, Aris Mining is advancing Toroparu, a gold/copper project. Aris Mining intends to pursue acquisitions and other growth opportunities to unlock value through scale and diversification.

Aris Mining promotes the formalization of traditional miners into contract mining partners as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at www.aris-mining.com, www.sedarplus.ca, and on www.sec.gov.

Forward-Looking Information

This news release contains "forward-looking information" or "forward-looking statements" within the meaning of Canadian and U.S. securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to our 2025 drilling program and its strategies, goals, and anticipated results, the Company's targeted and expected gold production, the timing of the Marmato Lower Mine expansion, the timing of the milestone payments under the WPMI precious metals purchase agreement, statements related to results of the 2024 mineral reserve and resource estimates and the Company's plans and strategies, are forward-looking. Generally, the forward-looking information and forward looking statements can be identified by the use of forward looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", "will continue" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this news release.

Statements concerning mineral resources and mineral reserve estimates may also be deemed to constitute forward looking information to the extent that they involve estimates of the mineralization that will be encountered.

Forward looking information and forward looking statements, while based on management's best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Aris Mining to be materially different from those expressed or implied by such forward-looking information or forward looking statements, including but not limited to those factors discussed in the section entitled "Risk Factors" in Aris Mining's Annual Information Form dated March 6, 2024 which is available on SEDAR+ at www.sedarplus.ca and in the Company's filings with the SEC at www.sec.gov. These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Differences in United States and Canadian Reporting Practices

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the Securities and Exchange Commission (the "SEC"). For example, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-reports-q3-2024-gold-production-updates-segovia-reserve-and-resource-estimates-and-expansion-milestones-302269308.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aris-mining-reports-q3-2024-gold-production-updates-segovia-reserve-and-resource-estimates-and-expansion-milestones-302269308.html

SOURCE Aris Mining Corporation