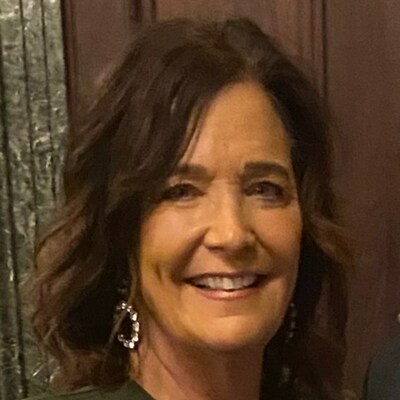

Aclaimant Embarks on Ambitious Journey to Risk Management Information System (RMIS) Leadership with New CEO Kathy Burns at the Forefront

CHICAGO, Feb. 15, 2024 /PRNewswire/ -- Chicago-based Aclaimant, the leading provider of next generation Risk Management Information Systems (RMIS), is pleased to announce the appointment of Kathy Burns as its new Chief Executive Officer. Burns will take the helm immediately, succeeding David Wald, who will continue to lead the organization as President and Co-Founder.

Burns brings over 30 years of experience in the insurance, technology and risk management industries, having served as CEO of Ventiv Technology, a solution provider of risk, insurance and underwriting technology solutions, from 2006 to 2015. She is currently an independent director of the Federal Home Loan Bank for Chicago, and from 2016 to 2023 served as the Chief Digital Officer at Ryan Specialty Group (NYSE:RYAN), where she led significant growth initiatives and drove innovation as the CEO of The Connector, the industry's first wholesale online trading platform.

"Aclaimant stands at the forefront of transforming how businesses approach risk management" said Burns. "The RMIS industry is consolidating and there are fewer choices for organizations looking to add RMIS capabilities. Aclaimant aims to catalyze the coming mass adoption of risk management technologies for companies who want to protect what matters most. As partners David, our incredible leadership, and I team will deliver a next generation RMIS platform. We will empower our customers to improve workplace safety, risk management and claims through better data, enhanced connectivity and more informed decision making."

"Kathy's vision for the future of risk management, combined with her proven track record and tenure of strategic leadership in the RMIS space, makes her the ideal choice to lead Aclaimant into its next chapter," said David Wald, President and Co-Founder, "We are confident that her expertise will be invaluable as we continue to grow Aclaimant into a world class RMIS organization together."

For more information about Aclaimant and its RMIS solutions, please visit www.aclaimant.com.

About Aclaimant

Aclaimant is a next generation Risk Management Information System (RMIS) designed to empower every organization to protect what matters most. Our intuitive, easy to use and powerful platform enables companies to reduce the cost of risk and drive higher productivity while empowering every employee to be a risk manager. Aclaimant transforms how companies manage data, people, and processes through its workplace safety, incident and claims management, and analytics solutions. Thousands of safety and risk management professionals rely on Aclaimant to achieve better outcomes. For more information, visit https://aclaimant.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aclaimant-embarks-on-ambitious-journey-to-risk-management-information-system-rmis-leadership-with-new-ceo-kathy-burns-at-the-forefront-302063273.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aclaimant-embarks-on-ambitious-journey-to-risk-management-information-system-rmis-leadership-with-new-ceo-kathy-burns-at-the-forefront-302063273.html

SOURCE Aclaimant